AMERICAN WATER REPORTS SOLID SECOND QUARTER 2024 RESULTS; NARROWS 2024 EPS GUIDANCE TO TOP HALF OF RANGE; AFFIRMS LONG-TERM TARGETS; ANNOUNCES LEADERSHIP CHANGES

- Second quarter 2024 earnings were $1.42 per share, compared to $1.44 per share in 2023; year-to-date 2024 earnings were $2.37 per share, compared to $2.37 per share in 2023

- Quarter and year-to-date 2023 and 2024 comparative results reflect a net unfavorable weather impact of an estimated $0.04 per share

- 2024 earnings per share guidance range is narrowed to $5.25 to $5.30 from $5.20 to $5.30, on a weather-normalized basis, including the estimated $0.10 per share of increased interest income as discussed last quarter, as a result of lower than expected declines in customer usage; long-term targets affirmed

- 2024 capital investment plan of $3.1 billion on track; approx. 43,000 customer connections added from acquisitions and organic growth through June 30

- Significant regulatory execution YTD with new rates effective in IN, WV, KY, and with new rates to go into effect in PA next week

- 2023 Sustainability Report published in July

- Leadership team changes: Effective August 1, 2024, M. Susan Hardwick remains CEO and American Water Board member and John C. Griffith named President of American Water; Cheryl Norton expands COO role to include Business Development; David Bowler named CFO; Nicholas Furia named Treasurer

CAMDEN, N.J., July 31, 2024- American Water Works Company, Inc. (NYSE: AWK) today reported results for the quarter ended June 30, 2024, of $1.42 per share, compared to $1.44 per share for the same quarter in 2023 and $2.37 per share for the year-to-date period ended June 30, 2024, compared to $2.37 per share for the same period in 2023.

“The company delivered solid results for the first half of the year,” said M. Susan Hardwick, president and CEO of American Water. “While results are relatively flat year over year, that is what we expected as we will see the results of our recent regulatory outcomes in the latter part of this year.”

“In the first six months of 2024, we invested $1.4 billion with the majority dedicated to needed infrastructure improvements to better serve our customers,” said Hardwick. “This included $119 million of acquisitions closed in Illinois, New Jersey, and Virginia, all of which are included in their respective current rate cases.”

2024 EPS Guidance Narrowed to Top Half of Range; Long-Term Financial Targets Affirmed

The company now expects its 2024 earnings per share guidance range to be $5.25 to $5.30, narrowed from the previous EPS guidance range of $5.20 to $5.30, on a weather-normalized basis. Both ranges include approximately $0.10 per share of increased interest income resulting from the early 2024 amendment to the terms of the secured seller note receivable from the 2021 sale of the former Homeowner Services Group (“HOS”). The Company affirms its long-term financial targets, including its long-term EPS and dividend growth rate targets of 7-9%. The company’s earnings forecasts are subject to numerous risks and uncertainties, including, without limitation, those described under “Cautionary Statement Concerning Forward-Looking Statements” below and under “Risk Factors” in its annual, quarterly, and current reports filed with the Securities and Exchange Commission (“SEC”). All statements related to earnings and earnings per share refer to diluted earnings and earnings per share.

Consolidated Results

For the three and six months ended June 30, 2024, earnings per share were $1.42 and $2.37, respectively, compared to $1.44 and $2.37 per share in the same periods in 2023. Results include the implementation of new rates in the Regulated Businesses from its capital and acquisition investments. Results also reflect some increased production and employee-related costs and higher financing costs to fund the current capital investment plan. Results for the three and six months ended June 30, 2024 compared to the same periods in 2023, reflect a net unfavorable impact of weather of $0.04 per share, including an estimated $0.03 and $0.07 per share, respectively, of impact due to warm, dry weather in the second quarter of 2024, primarily in New Jersey, and in the second quarter of 2023 in the Northeast and Midwest. Results for the three and six months ended June 30, 2024, include additional interest income of $0.02 and $0.04 per share, respectively, resulting from the early 2024 amendment to the secured seller note from the sale of the former HOS business.

The company is on track to meet its capital investment plan for the year with investments of $1.4 billion in the first six months of 2024, including $1.3 billion for infrastructure improvements and replacements, primarily in the Regulated Businesses, and $119 million for acquisitions. The company plans to invest a total of approximately $3.1 billion across its footprint in 2024.

Regulated Businesses

In the second quarter of 2024, the Regulated Businesses’ net income was $274 million, compared to $278 million for the same period in 2023. For the first six months of 2024, the Regulated Businesses’ net income was $459 million, compared to $452 million for the same period in 2023.

Operating revenues increased $52 million and $120 million for the three and six months ended June 30, 2024, respectively, as compared to the same periods in 2023. The increase in operating revenues was primarily a result of authorized revenue increases from completed general rate cases and infrastructure proceedings for the recovery of incremental capital and acquisition investments.

Since January 1, 2024, the company has been authorized additional annualized revenues of $176 million from general rate cases. Further, $90 million of additional annualized revenues from infrastructure surcharges have been authorized and are effective. The company has general rate cases in progress in seven jurisdictions and has filed for infrastructure surcharges in one jurisdiction, reflecting a total annualized revenue request of $546 million. Most of the additional authorized revenues in 2024 have effective dates in the second or third quarter of this year.

Operating expenses were higher by $37 million and $76 million for the three and six months ended June 30, 2024, respectively, as compared to the same periods in 2023. Operating expenses were higher primarily due to increased production costs, which include higher purchased water usage, fuel, power and chemicals costs, and an increase in employee related costs, as well as general taxes associated with increased capital investment. Depreciation expense was higher by $17 million and $32 million in the same periods, respectively, due to the growing capital investment.

Interest expense was higher by $12 million and $22 million for the three and six months ended June 30, 2024, respectively, as compared to the same periods in 2023, to fund capital investments.

Dividends

On July 31, 2024, the company’s Board of Directors declared a quarterly cash dividend payment of $0.7650 per share, payable on September 4, 2024, to shareholders of record as of August 13, 2024.

Leadership Team Changes

As part of the robust succession process, American Water announced leadership changes effective August 1, 2024, by naming John C. Griffith as President of American Water and expanding the role of Cheryl Norton, Executive Vice President and Chief Operating Officer, to include Business Development. M. Susan Hardwick remains CEO, as well as an American Water Board member. David Bowler has been named Executive Vice President and Chief Financial Officer and Nicholas Furia has been named Vice President and Treasurer.

“We are excited about our leadership news with key internal leaders taking expanded roles. Building strong talent and exceptional teams within our company is an important strength and differentiator of American Water and we, along with the American Water Board of Directors, are highly confident this structure will support the execution of our plans now and well into the future,” said Hardwick. “In addition to his tenure with American Water, John has more than 25 years of industry knowledge and expertise and has significant experience in leading high-performing teams, strategy development and execution. He has a deep understanding of our company’s purpose and a strong commitment to our customers, employees and shareholders.

“As our COO and with more than 35 years of proven experience, Cheryl has played a pivotal role in executing our increased capital plan to ensure our water and wastewater systems are reliable and resilient. Having her lead the enhanced business development team that helps bring our services to new communities is a natural expansion of her leadership role.”

“David, with over four years at American Water, has been our Deputy CFO and Treasurer since 2022 and has significant experience in all aspects of financial management and strategy, including finance strategy and planning, treasury, accounting, enterprise risk and capital markets,” added Hardwick.

“Today’s changes further solidify an already top-talented leadership team,” said Karl F. Kurz, Board Chair of American Water. “Our Board is committed to the continued long-term success of this company, and the execution of our extensive succession planning is a key part of that commitment. On behalf of the Board, I want to thank and congratulate Susan, John, Cheryl, David, and Nick for the roles they are playing in the current and future success of American Water.”

Biographies on Griffith, Norton, Bowler and Furia can be found at ir.amwater.com/governance/officers.

2024 Second Quarter Earnings Conference Call

The conference call to discuss second quarter 2024 earnings, 2024 earnings guidance, and long-term targets will take place on Thursday, August 1, 2024, at 9 a.m. Eastern Daylight Time. Interested parties may listen to an audio webcast through a link on the company’s Investor Relations website at ir.amwater.com. Presentation slides that will be used in conjunction with the earnings conference call will also be made available online in advance at ir.amwater.com. The company recognizes its website as a key channel of distribution to reach public investors and as a means of disclosing material non-public information to comply with its obligations under SEC Regulation FD.

Following the earnings conference call, a replay of the audio webcast will be available for one year on American Water’s investor relations website at ir.amwater.com/events.

About American Water

American Water (NYSE: AWK) is the largest regulated water and wastewater utility company in the United States. With a history dating back to 1886, We Keep Life Flowing® by providing safe, clean, reliable and affordable drinking water and wastewater services to more than 14 million people with regulated operations in 14 states and on 18 military installations. American Water’s 6,500 talented professionals leverage their significant expertise and the company’s national size and scale to achieve excellent outcomes for the benefit of customers, employees, investors and other stakeholders.

For more information, visit amwater.com and join American Water on LinkedIn, Facebook, X and Instagram.

Throughout this press release, unless the context otherwise requires, references to the “company” and “American Water” mean American Water Works Company, Inc. and all of its subsidiaries, taken together as a whole.

Cautionary Statement Concerning Forward-Looking Statements

Certain statements in this press release including, without limitation, 2024 earnings guidance, the company’s long-term financial, growth and dividend targets, the ability to achieve the company’s strategies and goals, customer affordability and acquired customer growth, the outcome of the company’s pending acquisition activity, the amount and allocation of projected capital expenditures, and estimated revenues from rate cases and other government agency authorizations, are forward-looking statements within the meaning of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 and the Federal securities laws. In some cases, these forward-looking statements can be identified by words with prospective meanings such as “intend,” “plan,” “estimate,” “believe,” “anticipate,” “expect,” “predict,” “project,” “propose,” “assume,” “forecast,” “outlook,” “likely,” “uncertain,” “future,” “pending,” “goal,” “objective,” “potential,” “continue,” “seek to,” “may,” “can,” “will,” “should” and “could” and or the negative of such terms or other variations or similar expressions. These forward-looking statements are predictions based on American Water’s current expectations and assumptions regarding future events. They are not guarantees or assurances of any outcomes, financial results, levels of activity, performance or achievements, and readers are cautioned not to place undue reliance upon them. The forward-looking statements are subject to a number of estimates and assumptions, and known and unknown risks, uncertainties and other factors. Actual results may vary materially from those discussed in the forward-looking statements included in this press release as a result of the factors discussed in the company’s Annual Report on Form 10-K for the year ended December 31, 2023, and subsequent filings with the SEC, and because of factors such as: the decisions of governmental and regulatory bodies, including decisions to raise or lower customer rates; the timeliness and outcome of regulatory commissions’ and other authorities’ actions concerning rates, capital structure, authorized return on equity, capital investment, system acquisitions and dispositions, taxes, permitting, water supply and management, and other decisions; changes in customer demand for, and patterns of use of, water and energy, such as may result from conservation efforts, or otherwise; limitations on the availability of the company’s water supplies or sources of water, or restrictions on its use thereof, resulting from allocation rights, governmental or regulatory requirements and restrictions, drought, overuse or other factors; a loss of one or more large industrial or commercial customers due to adverse economic conditions, or other factors; present and future proposed changes in laws, governmental regulations and policies, including with respect to the environment (such as, for example, potential improvements to existing Federal regulations with respect to lead and copper service lines and galvanized steel pipe), health and safety, data and consumer privacy, security and protection, water quality and water quality accountability, contaminants of emerging concern (including without limitation per- and polyfluoroalkyl substances (“PFAS”)), public utility and tax regulations and policies, and impacts resulting from U.S., state and local elections and changes in federal, state and local executive administrations; the company’s ability to collect, distribute, use, secure and store consumer data in compliance with current or future governmental laws, regulations and policies with respect to data and consumer privacy, security and protection; weather conditions and events, climate variability patterns, and natural disasters, including drought or abnormally high rainfall, prolonged and abnormal ice or freezing conditions, strong winds, coastal and intercoastal flooding, pandemics (including COVID-19) and epidemics, earthquakes, landslides, hurricanes, tornadoes, wildfires, electrical storms, sinkholes and solar flares; the outcome of litigation and similar governmental and regulatory proceedings, investigations or actions; the risks associated with the company’s aging infrastructure, and its ability to appropriately improve the resiliency of or maintain, update, redesign and/or replace, current or future infrastructure and systems, including its technology and other assets, and manage the expansion of its businesses; exposure or infiltration of the company’s technology and critical infrastructure systems, including the disclosure of sensitive, personal or confidential information contained therein, through physical or cyber attacks or other means, and impacts from required or voluntary public and other disclosures related thereto; the company’s ability to obtain permits and other approvals for projects and construction, update, redesign and/or replacement of various water and wastewater facilities; changes in the company’s capital requirements; the company’s ability to control operating expenses and to achieve operating efficiencies, and the company’s ability to create, maintain and promote initiatives and programs that support the affordability of the company’s regulated utility services; the intentional or unintentional actions of a third party, including contamination of the company’s water supplies or the water provided to its customers; the company’s ability to obtain and have delivered adequate and cost-effective supplies of pipe, equipment (including personal protective equipment), chemicals, power and other fuel, water and other raw materials, and to address or mitigate supply chain constraints that may result in delays or shortages in, as well as increased costs of, supplies, products and materials that are critical to or used in the company’s business operations; the company’s ability to successfully meet its operational growth projections, either individually or in the aggregate, and capitalize on growth opportunities, including, among other things, with respect to acquiring, closing and successfully integrating regulated operations, including without limitation the company’s ability to (i) obtain required regulatory approvals for such acquisitions, (ii) prevail in litigation or other challenges related to such acquisitions, and (iii) recover in rates the fair value of assets of the acquired regulated operations, the company’s Military Services Group entering into new military installation contracts, price redeterminations, and other agreements and contracts with the U.S. government, and realizing anticipated benefits and synergies from new acquisitions; risks and uncertainties following the completion of the sale of the company’s former HOS business, including the company’s ability to receive amounts due, payable and owing to the company under the amended secured seller note when due, and the ability of the company to redeploy successfully and timely the net proceeds of this transaction into the company’s Regulated Businesses; risks and uncertainties associated with contracting with the U.S. government, including ongoing compliance with applicable government procurement and security regulations; cost overruns relating to improvements in or the expansion of the company’s operations; the company’s ability to successfully develop and implement new technologies and to protect related intellectual property; the company’s ability to maintain safe work sites; the company’s exposure to liabilities related to environmental laws and regulations, including those enacted or adopted and under consideration, and the substances related thereto, including without limitation lead and galvanized steel, PFAS and other contaminants of emerging concern, and similar matters resulting from, among other things, water and wastewater service provided to customers; the ability of energy providers, state governments and other third parties to achieve or fulfill their greenhouse gas emission reduction goals, including without limitation through stated renewable portfolio standards and carbon transition plans; changes in general economic, political, business and financial market conditions; access to sufficient debt and/or equity capital on satisfactory terms and as needed to support operations and capital expenditures; fluctuations in inflation or interest rates, and the company’s ability to address or mitigate the impacts thereof; the ability to comply with affirmative or negative covenants in the current or future indebtedness of the company or any of its subsidiaries, or the issuance of new or modified credit ratings or outlooks by credit rating agencies with respect to the company or any of its subsidiaries (or any current or future indebtedness thereof), which could increase financing costs or funding requirements and affect the company’s or its subsidiaries’ ability to issue, repay or redeem debt, pay dividends or make distributions; fluctuations in the value of, or assumptions and estimates related to, its benefit plan assets and liabilities, including with respect to its pension and other post-retirement benefit plans, that could increase expenses and plan funding requirements; changes in federal or state general, income and other tax laws, including (i) future significant tax legislation or regulations (including without limitation impacts related to the Corporate Alternative Minimum Tax); and (ii) the availability of, or the company’s compliance with, the terms of applicable tax credits and tax abatement programs; migration of customers into or out of the company’s service territories and changes in water and energy consumption resulting therefrom; the use by municipalities of the power of eminent domain or other authority to condemn the systems of one or more of the company’s utility subsidiaries, including without limitation litigation and other proceedings with respect to the water system assets of the company’s California subsidiary located in Monterey, California, or the assertion by private landowners of similar rights against such utility subsidiaries; any difficulty or inability to obtain insurance for the company, its inability to obtain insurance at acceptable rates and on acceptable terms and conditions, or its inability to obtain reimbursement under existing or future insurance programs and coverages for any losses sustained; the incurrence of impairment charges, changes in fair value and other adjustments related to the company’s goodwill or the value of its other assets; labor actions, including work stoppages and strikes; the company’s ability to retain and attract highly qualified and skilled employees and/or diverse talent; civil disturbances or unrest, or terrorist threats or acts, or public apprehension about future disturbances, unrest, or terrorist threats or acts; and the impact of new, and changes to existing, accounting standards.

These forward-looking statements are qualified by, and should be read together with, the risks and uncertainties set forth above, and the risk factors included in American Water’s annual, quarterly and other SEC filings, and readers should refer to such risks, uncertainties and risk factors in evaluating such forward-looking statements. Any forward-looking statements American Water makes speak only as of the date of this press release. American Water does not have or undertake any obligation or intention to update or revise any forward-looking statement, whether as a result of new information, future events, changed circumstances or otherwise, except as otherwise required by the federal securities laws. New factors emerge from time to time, and it is not possible for the company to predict all such factors. Furthermore, it may not be possible to assess the impact of any such factor on the company’s businesses, either viewed independently or together, or the extent to which any factor, or combination of factors, may cause results to differ materially from those contained in any forward-looking statement. The foregoing factors should not be construed as exhaustive.

AWK-IR

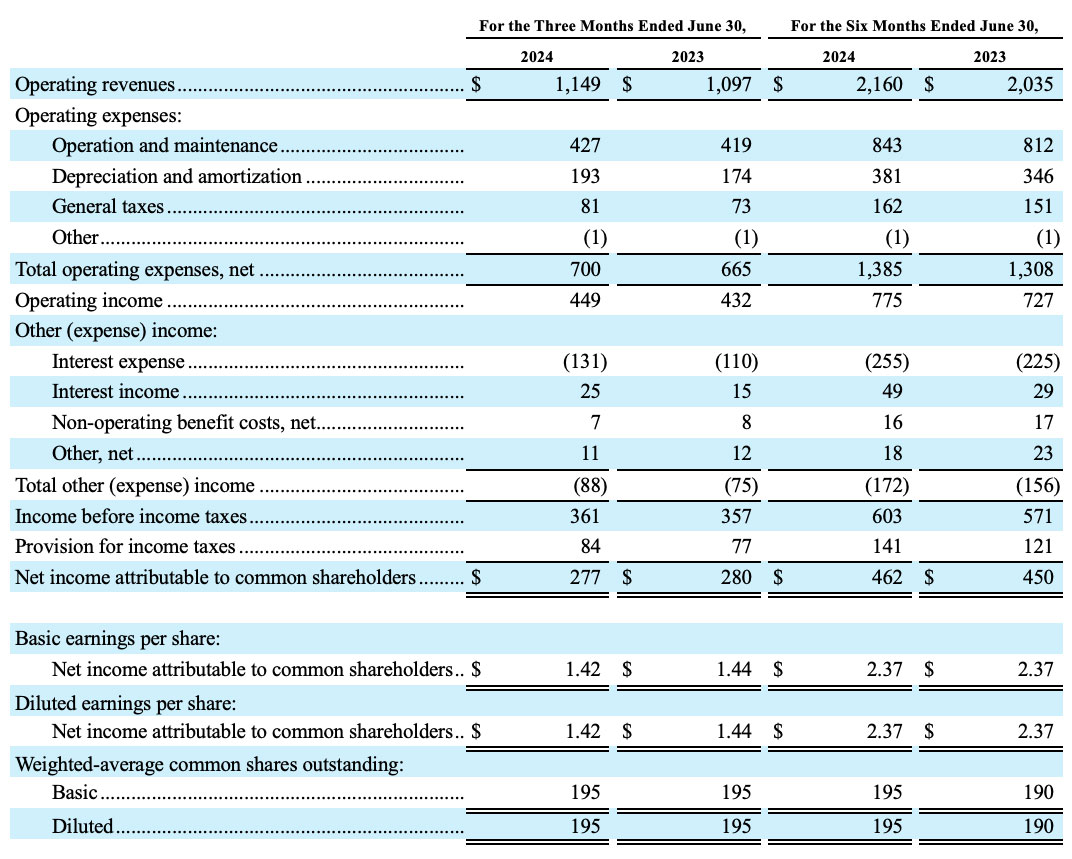

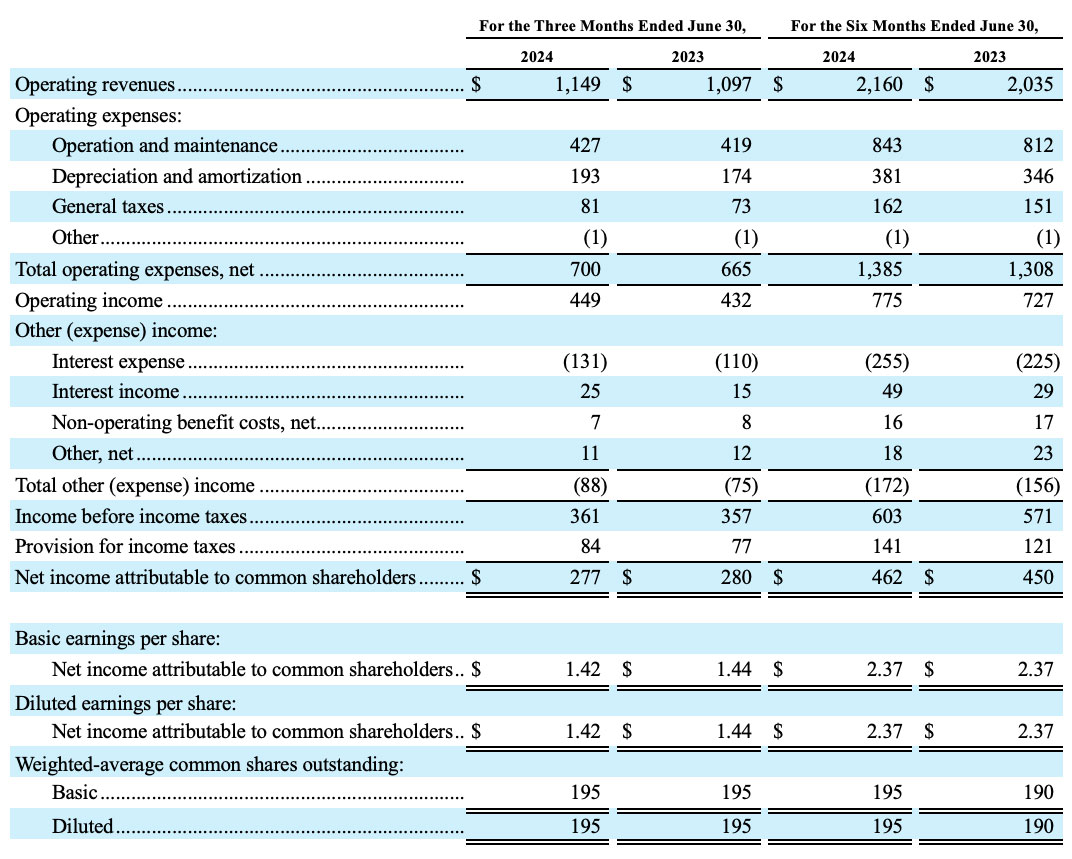

American Water Works Company, Inc. and Subsidiary Companies

Consolidated Statements of Operations (Unaudited)

(In millions, except per share data)

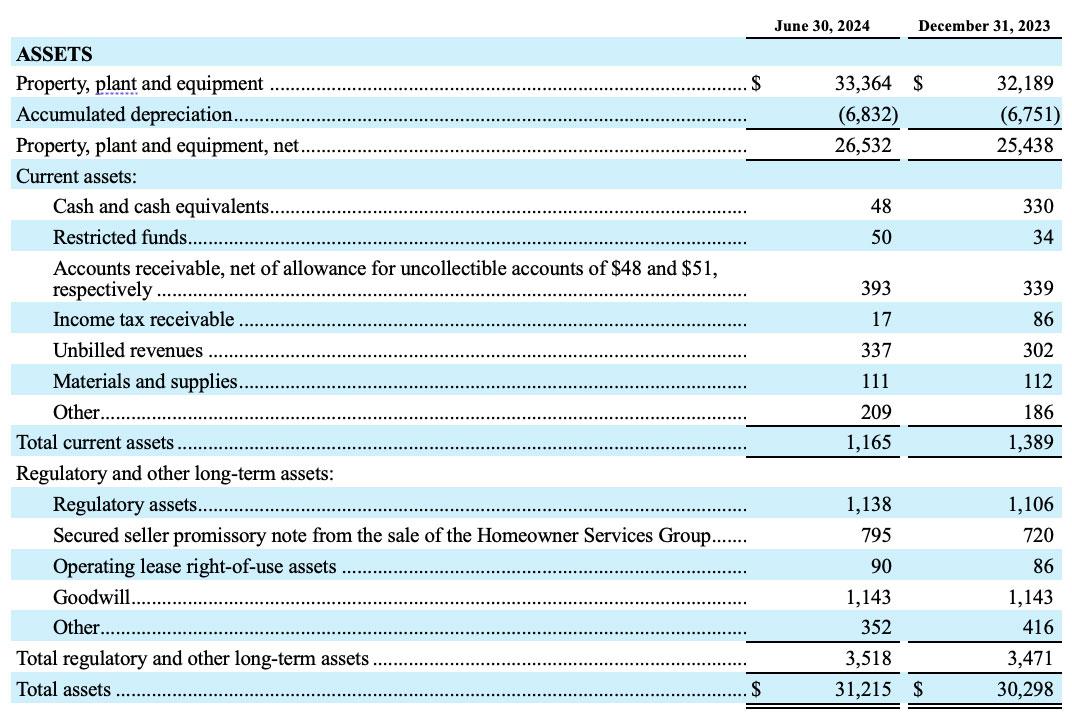

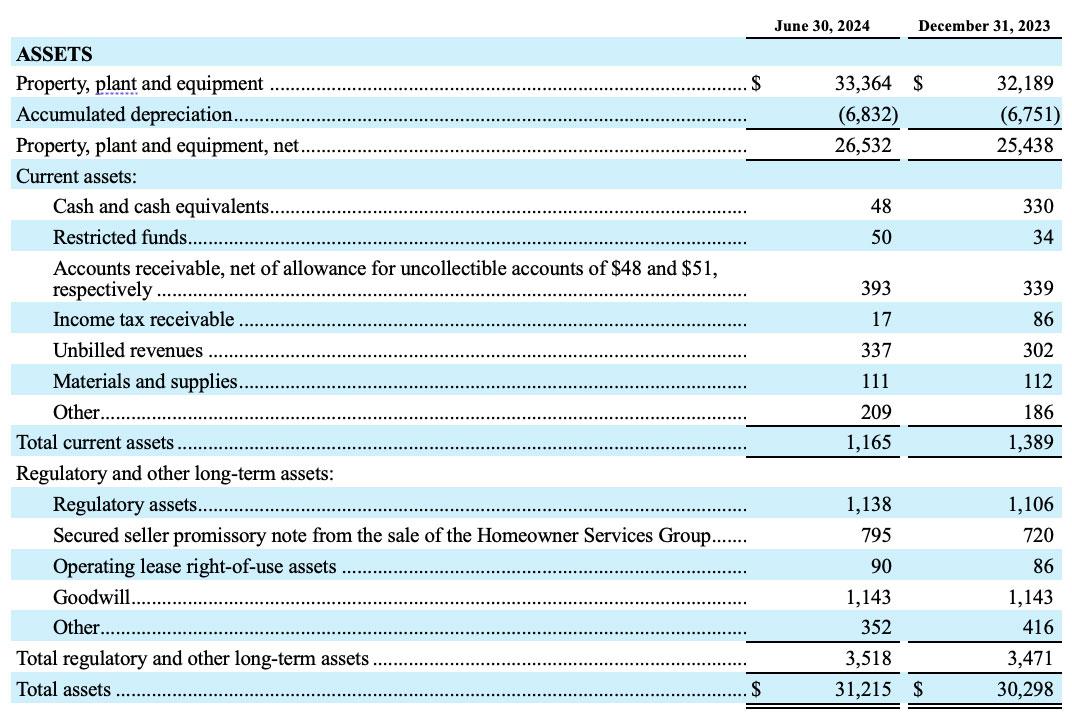

American Water Works Company, Inc. and Subsidiary Companies

Consolidated Balance Sheets (Unaudited)

(In millions, except share and per share data)

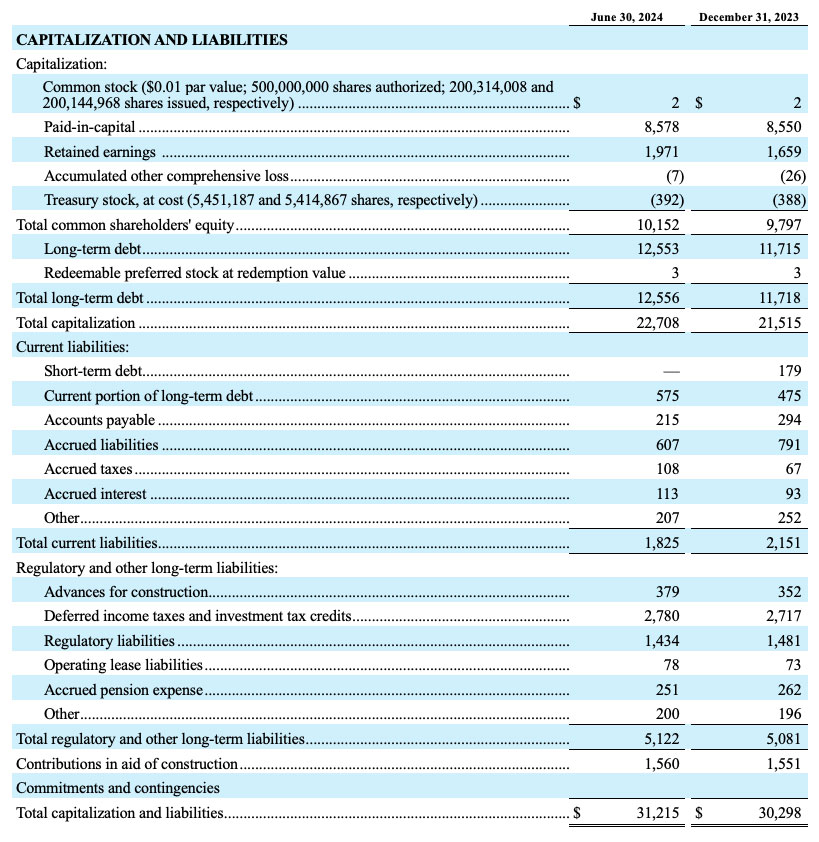

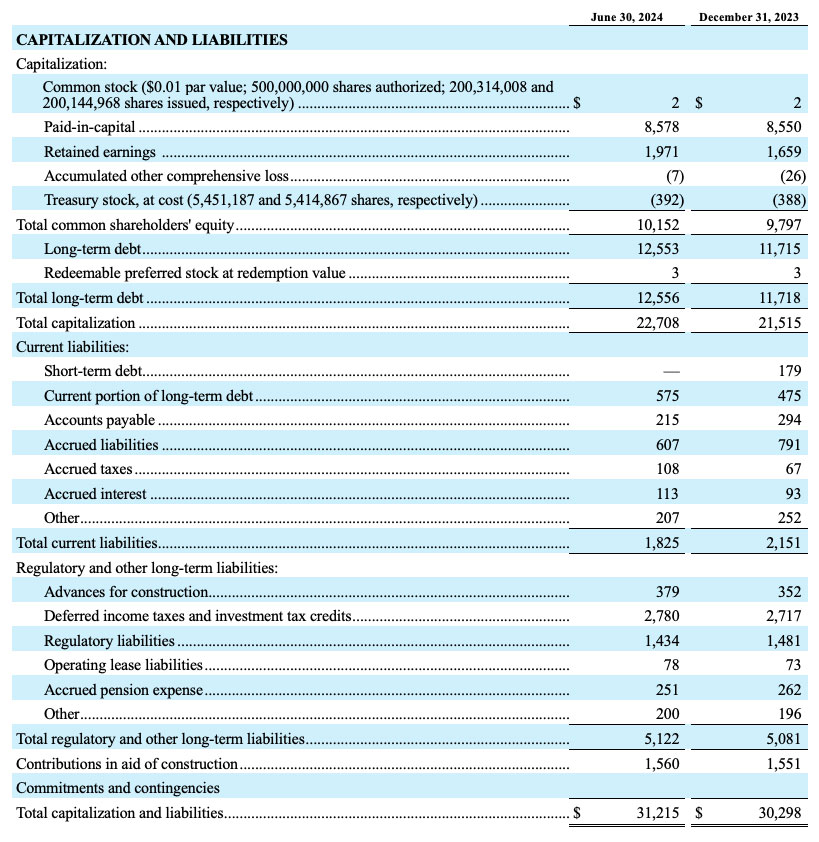

American Water Works Company, Inc. and Subsidiary Companies

Consolidated Balance Sheets (Unaudited)

(In millions, except share and per share data)

Media Contacts

Maureen Duffy

Senior Vice President, Communications and External Affairs

(856) 955-4163

maureen.duffy@amwater.com

- Second quarter 2024 earnings were $1.42 per share, compared to $1.44 per share in 2023; year-to-date 2024 earnings were $2.37 per share, compared to $2.37 per share in 2023

- Quarter and year-to-date 2023 and 2024 comparative results reflect a net unfavorable weather impact of an estimated $0.04 per share

- 2024 earnings per share guidance range is narrowed to $5.25 to $5.30 from $5.20 to $5.30, on a weather-normalized basis, including the estimated $0.10 per share of increased interest income as discussed last quarter, as a result of lower than expected declines in customer usage; long-term targets affirmed

- 2024 capital investment plan of $3.1 billion on track; approx. 43,000 customer connections added from acquisitions and organic growth through June 30

- Significant regulatory execution YTD with new rates effective in IN, WV, KY, and with new rates to go into effect in PA next week

- 2023 Sustainability Report published in July

- Leadership team changes: Effective August 1, 2024, M. Susan Hardwick remains CEO and American Water Board member and John C. Griffith named President of American Water; Cheryl Norton expands COO role to include Business Development; David Bowler named CFO; Nicholas Furia named Treasurer

CAMDEN, N.J., July 31, 2024- American Water Works Company, Inc. (NYSE: AWK) today reported results for the quarter ended June 30, 2024, of $1.42 per share, compared to $1.44 per share for the same quarter in 2023 and $2.37 per share for the year-to-date period ended June 30, 2024, compared to $2.37 per share for the same period in 2023.

“The company delivered solid results for the first half of the year,” said M. Susan Hardwick, president and CEO of American Water. “While results are relatively flat year over year, that is what we expected as we will see the results of our recent regulatory outcomes in the latter part of this year.”

“In the first six months of 2024, we invested $1.4 billion with the majority dedicated to needed infrastructure improvements to better serve our customers,” said Hardwick. “This included $119 million of acquisitions closed in Illinois, New Jersey, and Virginia, all of which are included in their respective current rate cases.”

2024 EPS Guidance Narrowed to Top Half of Range; Long-Term Financial Targets Affirmed

The company now expects its 2024 earnings per share guidance range to be $5.25 to $5.30, narrowed from the previous EPS guidance range of $5.20 to $5.30, on a weather-normalized basis. Both ranges include approximately $0.10 per share of increased interest income resulting from the early 2024 amendment to the terms of the secured seller note receivable from the 2021 sale of the former Homeowner Services Group (“HOS”). The Company affirms its long-term financial targets, including its long-term EPS and dividend growth rate targets of 7-9%. The company’s earnings forecasts are subject to numerous risks and uncertainties, including, without limitation, those described under “Cautionary Statement Concerning Forward-Looking Statements” below and under “Risk Factors” in its annual, quarterly, and current reports filed with the Securities and Exchange Commission (“SEC”). All statements related to earnings and earnings per share refer to diluted earnings and earnings per share.

Consolidated Results

For the three and six months ended June 30, 2024, earnings per share were $1.42 and $2.37, respectively, compared to $1.44 and $2.37 per share in the same periods in 2023. Results include the implementation of new rates in the Regulated Businesses from its capital and acquisition investments. Results also reflect some increased production and employee-related costs and higher financing costs to fund the current capital investment plan. Results for the three and six months ended June 30, 2024 compared to the same periods in 2023, reflect a net unfavorable impact of weather of $0.04 per share, including an estimated $0.03 and $0.07 per share, respectively, of impact due to warm, dry weather in the second quarter of 2024, primarily in New Jersey, and in the second quarter of 2023 in the Northeast and Midwest. Results for the three and six months ended June 30, 2024, include additional interest income of $0.02 and $0.04 per share, respectively, resulting from the early 2024 amendment to the secured seller note from the sale of the former HOS business.

The company is on track to meet its capital investment plan for the year with investments of $1.4 billion in the first six months of 2024, including $1.3 billion for infrastructure improvements and replacements, primarily in the Regulated Businesses, and $119 million for acquisitions. The company plans to invest a total of approximately $3.1 billion across its footprint in 2024.

Regulated Businesses

In the second quarter of 2024, the Regulated Businesses’ net income was $274 million, compared to $278 million for the same period in 2023. For the first six months of 2024, the Regulated Businesses’ net income was $459 million, compared to $452 million for the same period in 2023.

Operating revenues increased $52 million and $120 million for the three and six months ended June 30, 2024, respectively, as compared to the same periods in 2023. The increase in operating revenues was primarily a result of authorized revenue increases from completed general rate cases and infrastructure proceedings for the recovery of incremental capital and acquisition investments.

Since January 1, 2024, the company has been authorized additional annualized revenues of $176 million from general rate cases. Further, $90 million of additional annualized revenues from infrastructure surcharges have been authorized and are effective. The company has general rate cases in progress in seven jurisdictions and has filed for infrastructure surcharges in one jurisdiction, reflecting a total annualized revenue request of $546 million. Most of the additional authorized revenues in 2024 have effective dates in the second or third quarter of this year.

Operating expenses were higher by $37 million and $76 million for the three and six months ended June 30, 2024, respectively, as compared to the same periods in 2023. Operating expenses were higher primarily due to increased production costs, which include higher purchased water usage, fuel, power and chemicals costs, and an increase in employee related costs, as well as general taxes associated with increased capital investment. Depreciation expense was higher by $17 million and $32 million in the same periods, respectively, due to the growing capital investment.

Interest expense was higher by $12 million and $22 million for the three and six months ended June 30, 2024, respectively, as compared to the same periods in 2023, to fund capital investments.

Dividends

On July 31, 2024, the company’s Board of Directors declared a quarterly cash dividend payment of $0.7650 per share, payable on September 4, 2024, to shareholders of record as of August 13, 2024.

Leadership Team Changes

As part of the robust succession process, American Water announced leadership changes effective August 1, 2024, by naming John C. Griffith as President of American Water and expanding the role of Cheryl Norton, Executive Vice President and Chief Operating Officer, to include Business Development. M. Susan Hardwick remains CEO, as well as an American Water Board member. David Bowler has been named Executive Vice President and Chief Financial Officer and Nicholas Furia has been named Vice President and Treasurer.

“We are excited about our leadership news with key internal leaders taking expanded roles. Building strong talent and exceptional teams within our company is an important strength and differentiator of American Water and we, along with the American Water Board of Directors, are highly confident this structure will support the execution of our plans now and well into the future,” said Hardwick. “In addition to his tenure with American Water, John has more than 25 years of industry knowledge and expertise and has significant experience in leading high-performing teams, strategy development and execution. He has a deep understanding of our company’s purpose and a strong commitment to our customers, employees and shareholders.

“As our COO and with more than 35 years of proven experience, Cheryl has played a pivotal role in executing our increased capital plan to ensure our water and wastewater systems are reliable and resilient. Having her lead the enhanced business development team that helps bring our services to new communities is a natural expansion of her leadership role.”

“David, with over four years at American Water, has been our Deputy CFO and Treasurer since 2022 and has significant experience in all aspects of financial management and strategy, including finance strategy and planning, treasury, accounting, enterprise risk and capital markets,” added Hardwick.

“Today’s changes further solidify an already top-talented leadership team,” said Karl F. Kurz, Board Chair of American Water. “Our Board is committed to the continued long-term success of this company, and the execution of our extensive succession planning is a key part of that commitment. On behalf of the Board, I want to thank and congratulate Susan, John, Cheryl, David, and Nick for the roles they are playing in the current and future success of American Water.”

Biographies on Griffith, Norton, Bowler and Furia can be found at ir.amwater.com/governance/officers.

2024 Second Quarter Earnings Conference Call

The conference call to discuss second quarter 2024 earnings, 2024 earnings guidance, and long-term targets will take place on Thursday, August 1, 2024, at 9 a.m. Eastern Daylight Time. Interested parties may listen to an audio webcast through a link on the company’s Investor Relations website at ir.amwater.com. Presentation slides that will be used in conjunction with the earnings conference call will also be made available online in advance at ir.amwater.com. The company recognizes its website as a key channel of distribution to reach public investors and as a means of disclosing material non-public information to comply with its obligations under SEC Regulation FD.

Following the earnings conference call, a replay of the audio webcast will be available for one year on American Water’s investor relations website at ir.amwater.com/events.

About American Water

American Water (NYSE: AWK) is the largest regulated water and wastewater utility company in the United States. With a history dating back to 1886, We Keep Life Flowing® by providing safe, clean, reliable and affordable drinking water and wastewater services to more than 14 million people with regulated operations in 14 states and on 18 military installations. American Water’s 6,500 talented professionals leverage their significant expertise and the company’s national size and scale to achieve excellent outcomes for the benefit of customers, employees, investors and other stakeholders.

For more information, visit amwater.com and join American Water on LinkedIn, Facebook, X and Instagram.

Throughout this press release, unless the context otherwise requires, references to the “company” and “American Water” mean American Water Works Company, Inc. and all of its subsidiaries, taken together as a whole.

Cautionary Statement Concerning Forward-Looking Statements

Certain statements in this press release including, without limitation, 2024 earnings guidance, the company’s long-term financial, growth and dividend targets, the ability to achieve the company’s strategies and goals, customer affordability and acquired customer growth, the outcome of the company’s pending acquisition activity, the amount and allocation of projected capital expenditures, and estimated revenues from rate cases and other government agency authorizations, are forward-looking statements within the meaning of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 and the Federal securities laws. In some cases, these forward-looking statements can be identified by words with prospective meanings such as “intend,” “plan,” “estimate,” “believe,” “anticipate,” “expect,” “predict,” “project,” “propose,” “assume,” “forecast,” “outlook,” “likely,” “uncertain,” “future,” “pending,” “goal,” “objective,” “potential,” “continue,” “seek to,” “may,” “can,” “will,” “should” and “could” and or the negative of such terms or other variations or similar expressions. These forward-looking statements are predictions based on American Water’s current expectations and assumptions regarding future events. They are not guarantees or assurances of any outcomes, financial results, levels of activity, performance or achievements, and readers are cautioned not to place undue reliance upon them. The forward-looking statements are subject to a number of estimates and assumptions, and known and unknown risks, uncertainties and other factors. Actual results may vary materially from those discussed in the forward-looking statements included in this press release as a result of the factors discussed in the company’s Annual Report on Form 10-K for the year ended December 31, 2023, and subsequent filings with the SEC, and because of factors such as: the decisions of governmental and regulatory bodies, including decisions to raise or lower customer rates; the timeliness and outcome of regulatory commissions’ and other authorities’ actions concerning rates, capital structure, authorized return on equity, capital investment, system acquisitions and dispositions, taxes, permitting, water supply and management, and other decisions; changes in customer demand for, and patterns of use of, water and energy, such as may result from conservation efforts, or otherwise; limitations on the availability of the company’s water supplies or sources of water, or restrictions on its use thereof, resulting from allocation rights, governmental or regulatory requirements and restrictions, drought, overuse or other factors; a loss of one or more large industrial or commercial customers due to adverse economic conditions, or other factors; present and future proposed changes in laws, governmental regulations and policies, including with respect to the environment (such as, for example, potential improvements to existing Federal regulations with respect to lead and copper service lines and galvanized steel pipe), health and safety, data and consumer privacy, security and protection, water quality and water quality accountability, contaminants of emerging concern (including without limitation per- and polyfluoroalkyl substances (“PFAS”)), public utility and tax regulations and policies, and impacts resulting from U.S., state and local elections and changes in federal, state and local executive administrations; the company’s ability to collect, distribute, use, secure and store consumer data in compliance with current or future governmental laws, regulations and policies with respect to data and consumer privacy, security and protection; weather conditions and events, climate variability patterns, and natural disasters, including drought or abnormally high rainfall, prolonged and abnormal ice or freezing conditions, strong winds, coastal and intercoastal flooding, pandemics (including COVID-19) and epidemics, earthquakes, landslides, hurricanes, tornadoes, wildfires, electrical storms, sinkholes and solar flares; the outcome of litigation and similar governmental and regulatory proceedings, investigations or actions; the risks associated with the company’s aging infrastructure, and its ability to appropriately improve the resiliency of or maintain, update, redesign and/or replace, current or future infrastructure and systems, including its technology and other assets, and manage the expansion of its businesses; exposure or infiltration of the company’s technology and critical infrastructure systems, including the disclosure of sensitive, personal or confidential information contained therein, through physical or cyber attacks or other means, and impacts from required or voluntary public and other disclosures related thereto; the company’s ability to obtain permits and other approvals for projects and construction, update, redesign and/or replacement of various water and wastewater facilities; changes in the company’s capital requirements; the company’s ability to control operating expenses and to achieve operating efficiencies, and the company’s ability to create, maintain and promote initiatives and programs that support the affordability of the company’s regulated utility services; the intentional or unintentional actions of a third party, including contamination of the company’s water supplies or the water provided to its customers; the company’s ability to obtain and have delivered adequate and cost-effective supplies of pipe, equipment (including personal protective equipment), chemicals, power and other fuel, water and other raw materials, and to address or mitigate supply chain constraints that may result in delays or shortages in, as well as increased costs of, supplies, products and materials that are critical to or used in the company’s business operations; the company’s ability to successfully meet its operational growth projections, either individually or in the aggregate, and capitalize on growth opportunities, including, among other things, with respect to acquiring, closing and successfully integrating regulated operations, including without limitation the company’s ability to (i) obtain required regulatory approvals for such acquisitions, (ii) prevail in litigation or other challenges related to such acquisitions, and (iii) recover in rates the fair value of assets of the acquired regulated operations, the company’s Military Services Group entering into new military installation contracts, price redeterminations, and other agreements and contracts with the U.S. government, and realizing anticipated benefits and synergies from new acquisitions; risks and uncertainties following the completion of the sale of the company’s former HOS business, including the company’s ability to receive amounts due, payable and owing to the company under the amended secured seller note when due, and the ability of the company to redeploy successfully and timely the net proceeds of this transaction into the company’s Regulated Businesses; risks and uncertainties associated with contracting with the U.S. government, including ongoing compliance with applicable government procurement and security regulations; cost overruns relating to improvements in or the expansion of the company’s operations; the company’s ability to successfully develop and implement new technologies and to protect related intellectual property; the company’s ability to maintain safe work sites; the company’s exposure to liabilities related to environmental laws and regulations, including those enacted or adopted and under consideration, and the substances related thereto, including without limitation lead and galvanized steel, PFAS and other contaminants of emerging concern, and similar matters resulting from, among other things, water and wastewater service provided to customers; the ability of energy providers, state governments and other third parties to achieve or fulfill their greenhouse gas emission reduction goals, including without limitation through stated renewable portfolio standards and carbon transition plans; changes in general economic, political, business and financial market conditions; access to sufficient debt and/or equity capital on satisfactory terms and as needed to support operations and capital expenditures; fluctuations in inflation or interest rates, and the company’s ability to address or mitigate the impacts thereof; the ability to comply with affirmative or negative covenants in the current or future indebtedness of the company or any of its subsidiaries, or the issuance of new or modified credit ratings or outlooks by credit rating agencies with respect to the company or any of its subsidiaries (or any current or future indebtedness thereof), which could increase financing costs or funding requirements and affect the company’s or its subsidiaries’ ability to issue, repay or redeem debt, pay dividends or make distributions; fluctuations in the value of, or assumptions and estimates related to, its benefit plan assets and liabilities, including with respect to its pension and other post-retirement benefit plans, that could increase expenses and plan funding requirements; changes in federal or state general, income and other tax laws, including (i) future significant tax legislation or regulations (including without limitation impacts related to the Corporate Alternative Minimum Tax); and (ii) the availability of, or the company’s compliance with, the terms of applicable tax credits and tax abatement programs; migration of customers into or out of the company’s service territories and changes in water and energy consumption resulting therefrom; the use by municipalities of the power of eminent domain or other authority to condemn the systems of one or more of the company’s utility subsidiaries, including without limitation litigation and other proceedings with respect to the water system assets of the company’s California subsidiary located in Monterey, California, or the assertion by private landowners of similar rights against such utility subsidiaries; any difficulty or inability to obtain insurance for the company, its inability to obtain insurance at acceptable rates and on acceptable terms and conditions, or its inability to obtain reimbursement under existing or future insurance programs and coverages for any losses sustained; the incurrence of impairment charges, changes in fair value and other adjustments related to the company’s goodwill or the value of its other assets; labor actions, including work stoppages and strikes; the company’s ability to retain and attract highly qualified and skilled employees and/or diverse talent; civil disturbances or unrest, or terrorist threats or acts, or public apprehension about future disturbances, unrest, or terrorist threats or acts; and the impact of new, and changes to existing, accounting standards.

These forward-looking statements are qualified by, and should be read together with, the risks and uncertainties set forth above, and the risk factors included in American Water’s annual, quarterly and other SEC filings, and readers should refer to such risks, uncertainties and risk factors in evaluating such forward-looking statements. Any forward-looking statements American Water makes speak only as of the date of this press release. American Water does not have or undertake any obligation or intention to update or revise any forward-looking statement, whether as a result of new information, future events, changed circumstances or otherwise, except as otherwise required by the federal securities laws. New factors emerge from time to time, and it is not possible for the company to predict all such factors. Furthermore, it may not be possible to assess the impact of any such factor on the company’s businesses, either viewed independently or together, or the extent to which any factor, or combination of factors, may cause results to differ materially from those contained in any forward-looking statement. The foregoing factors should not be construed as exhaustive.

AWK-IR

American Water Works Company, Inc. and Subsidiary Companies

Consolidated Statements of Operations (Unaudited)

(In millions, except per share data)

American Water Works Company, Inc. and Subsidiary Companies

Consolidated Balance Sheets (Unaudited)

(In millions, except share and per share data)

American Water Works Company, Inc. and Subsidiary Companies

Consolidated Balance Sheets (Unaudited)

(In millions, except share and per share data)

Media Contacts

Maureen Duffy

Senior Vice President, Communications and External Affairs

(856) 955-4163

maureen.duffy@amwater.com